GST Cess Hike On Luxury Cars Approved By Cabinet; SUVs To Get Pricier

Highlights

- Hike in cess on luxury cars and SUVs is now 25% from 15%

- Government will now push for a Presidential nod

- A formal notification will be presented to the GST Council on September 9

Affecting mid-size, luxury cars and SUVs, the Cabinet has cleared promulgation of an Ordinance to increase the GST cess from current 15 per cent under the new tax regime. The proposal before the cabinet was to hike the GST cess rate on premium cars to 25 per cent and the ordinance is the first step in that direction. In July this year, the new GST taxation regime rolled into the country bringing a host of state and central taxes under one umbrella. This led to a reduction in taxes over premium vehicles, bringing down prices as well. The government will now push for a Presidential approval soon for hiking maximum cap of GST cess. The Central Board of Excise and Customs (CBEC) will issue cess hike notification post the President gives his approval.

Also Read: 10 Per Cent Cess Hike: 10 Things To Know

The Cabinet's nod allows the government to increase the GST cess on luxury cars, SUVs via an ordinance. It will now put forward a formal notification to the GST Council in a meeting on September 9. "The proposal of imposition of higher cess has been cleared," a source said after the Cabinet meeting.

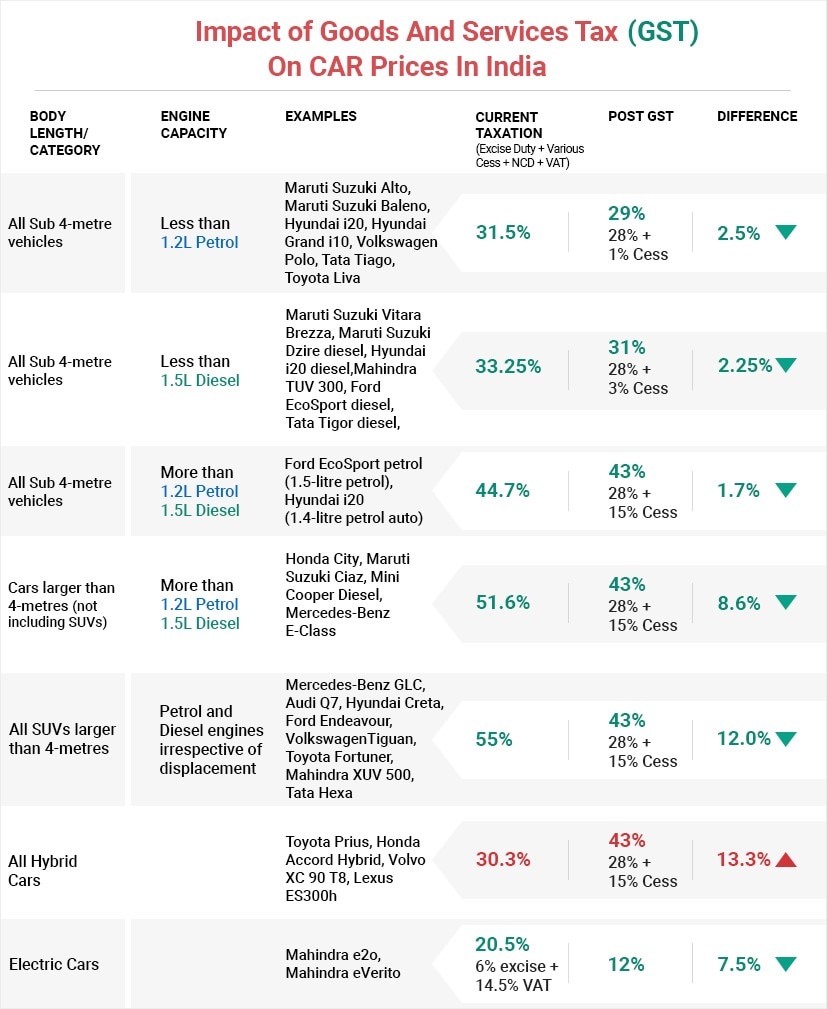

Prices of most SUVs were cut between Rs 1.1 lakh and Rs 3 lakh following the implementation of GST, which subsumed over a dozen central and state levies like excise duty, service tax, and VAT from July 1. Cars attract the top tax rate of 28 per cent. On top of this, a cess of 1 to 15 per cent is levied for the creation of the state compensation corpus.

Also Read: Mercedes-Benz Warn Of Prices Going Back To Pre-GST Level

To rectify the anomaly, the GST Council, headed by Union Finance Minister Arun Jaitley and comprising representatives of all states, had on August 5 recommended that the Central government move legislative amendments required for increasing the maximum ceiling of cess leviable on motor vehicles to 25 per cent from present 15 per cent.

(Union Cabinet approves levy on luxury cars and SUVs)

Also Read: GST Impact: Car Buyers To Bear Burden Of Additional Cess If Implemented Before Delivery Date

Once the law is amended, the GST Council will decide on the date when the increased cess will be applicable, the official said, adding the next meeting of the panel is scheduled to be held in Hyderabad on September 9. The highest pre-GST tax incidence on motor vehicles worked out to about 52-54.72 per cent, to which 2.5 per cent was added on account of Central Sales Tax, octroi etc. Against this, post-GST the total tax incidence came to 43 per cent.

Mercedes Benz India, Managing Director, Roland Folger, had said earlier that the situation may go back to "square one" due to levy of cess for large cars and Sports Utility vehicles if government does not intervene.

So, to take the tax incidence to pre-GST level, the highest compensation cess rate required is 25 per cent. Presently, large motor vehicles, SUVs, mid-segment cars, large cars, hybrid cars and hybrid motor vehicles attract a cess of 15 per cent on top of 28 per cent GST. Small petrol cars of less than 4 meters and 1,200 cc attract a cess of 1 per cent, while small diesel cars of less than 4 meters and 1,500 cc engine attract a cess of 3 per cent.

The auto industry is collectively disappointed by the decision. Here's how manufacturers reacted to the decision.

Watch this space for more.

Last Updated on August 30, 2017

Related Articles

Latest News

- Home

- News

- Auto Industry

- GST Cess Hike On Luxury Cars Approved By Cabinet; SUVs To Get Pricier