India's Used Car Players Welcome The Scrappage Policy But Do Not See Any Impact On The Segment

Highlights

- The government has announced Scrappage Policy for end of life vehicles

- The policy could help used car volumes grow in the long-term

- Companies believe the policy will not have any immediate impact

It has been over a month since the Government of India announced its Voluntary Scrappage Policy for end of life vehicles (ELVs). While there is still a long way to go before the policy officially comes into effect, however, vehicle manufacturers in India have already welcomed the initiative as it is bound to have long-term benefits for the industry. While on one hand, it will help take the old, polluting vehicles out of the roads, on the other, it will also prompt consumers to buy newer cars, translating into more sales. Having said that, will it have any major impact on the used car market? We reached out to some of the major players in the pre-owned car segment, and this is what they had to say.

Also Read: MoRTH Minister Nitin Gadkari Announces Scrappage Policy In Lok Sabha

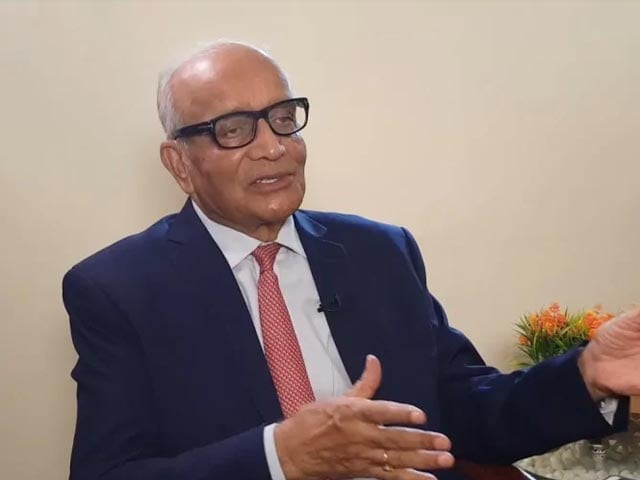

Maruti Suzuki India's True Value is one of the largest organised used car sellers in India, and when we asked the company's Chairman, RC Bhargava, what he believes will be the impact of the scrappage policy on the used car market, he said "The policy is yet to come into force. And it's going to be only with regards to cars which over 20 years old, which are found to be unfit. This is not going to come into effect for some time yet, so it's too early to speculate on its impact anywhere. Let's see what happens, and how the policy may get some refinement, something else might happen. At the moment, the policy is not even near implementation."

Also Read: 2021 Indian Blue Book Report: Used Car Market In India To Grow Significantly In Next Five Years

Maruti Suzuki India's Chairman, RC Bhargava says the policy is not going to come into effect for some time, so it's too early to speculate on its impact anywhere

Now the policy says that a private vehicle needs to be scrapped when it completes 20 years. Even then, it will be a voluntary move, and as long as the vehicle can clear the mandatory fitness test owners can choose to not scrap the vehicle. However, if the vehicle fails to clear 3 tests in a row, then it will have to be compulsorily scrapped. Having said that, on average, a vehicle owner sells his/her car after 5 to 6 years, which means there is still a long period left before the vehicle reaches the threshold for scraping, and within that period it could see 2 or 3 different owners. So, there's no real impact on the used car market in the short term.

Also Read: 7 Benefits Of Buying A Used Car

Santosh Iyer, Vice President, Sales & Marketing, Mercedes-Benz India believes the mass segment and the CV segment in specific will benefit the most from this policy

This is something even Santosh Iyer, Vice President, Sales & Marketing, Mercedes-Benz India agrees upon. Answering the same query for the luxury used car segment, Iyer said, "For luxury cars in general and pre-owned cars in particular, the policy will have less impact in the short-term. In the organized pre-owned luxury space operated by 'Mercedes-Benz Certified', most of the vehicles are in immaculate condition as they undergo stringent quality checks and are usually less than 5 years old. This makes the present scrappage policy less impactful for our pre-owned cars business in the initial few years." That said, he does believe that it is a step in the right direction and the mass segment and the CV segment in specific will benefit the most from this policy, however, that's in the long-term.

Also Read: 2021 Indian Blue Book Report: Used Car Sales Cross 4.2 Million Units Mark In FY20

Jatin Ahuja Founder and CEO of Big Boy Toyz says the scrappage policy has not created much of an impact on the pre-owned luxury car industry

Similar views were expressed by Jatin Ahuja Founder and CEO of Big Boy Toyz, a multi-branded luxury cars retail chain, who specifically spoke about the high-end car segment. He said, "The scrappage policy has not created much of an impact on the pre-owned luxury car industry as the consumer bracket that the industry caters to is very much different from the general used car industry which majorly deals in utility vehicles." He further added, "We at Big Boy Toyz house cars that are either 0 km run or are a year or two old and are in excellent condition. To have such cars at excellent condition within a price of choice, which is providing value for money, does not make the scrappage policy a concern for the brand or the consumers as a whole."

Sumit Garg, Co-Founder and MD, Luxury Ride says the voluntary scrappage policy, can drive the growth of used car volumes as customers start replacing their old cars with younger cars

While the scrappage policy might not have any immediate impact on the used car market, in the long-term it will help the volumes grow, and we'll see newer cars enter the used car space. In fact, talking about the long-term benefits for the pre-owned luxury car segment, Sumit Garg, Co-Founder and MD, Luxury Ride said, "The voluntary scrappage policy, can drive the growth of used car volumes as customers start replacing their old cars with younger cars. It will enable the supply of younger vehicles in the market which will help in rationalising the prices." Talking about the environmental benefits of the policy, Garg added, "If the policy is defined well, about 28 million vehicles could go off-road by 2025, largely comprising two-wheelers. It would reduce carbon dioxide emission by 17 per cent and cut particulate matter in the air by 24 per cent. Also, if half the Bharat Stage-II and III vehicles go off the roads, it would save 8 million tonnes of oil a year."

The scrappage policy is expected to come into effect for government vehicles in 2022, for CVs in 2023 and for other vehicles in 2024.

According to the information released by the government so far, vehicle owners who opt to scrape their vehicles will get some incentives. The policy proposes a road tax rebate of up to 25 per cent on personal vehicles, along with a 5 per cent manufacturer discount against the scrapping certificate and also a waiver in the registration fee while buying new vehicles. These are in addition to the scrap value of the old vehicle offered by the scrappage centre, which is about 4-6 per cent of the ex-showroom price. The policy is expected to come into effect for government vehicles in 2022, for CVs in 2023 and for other vehicles in 2024.